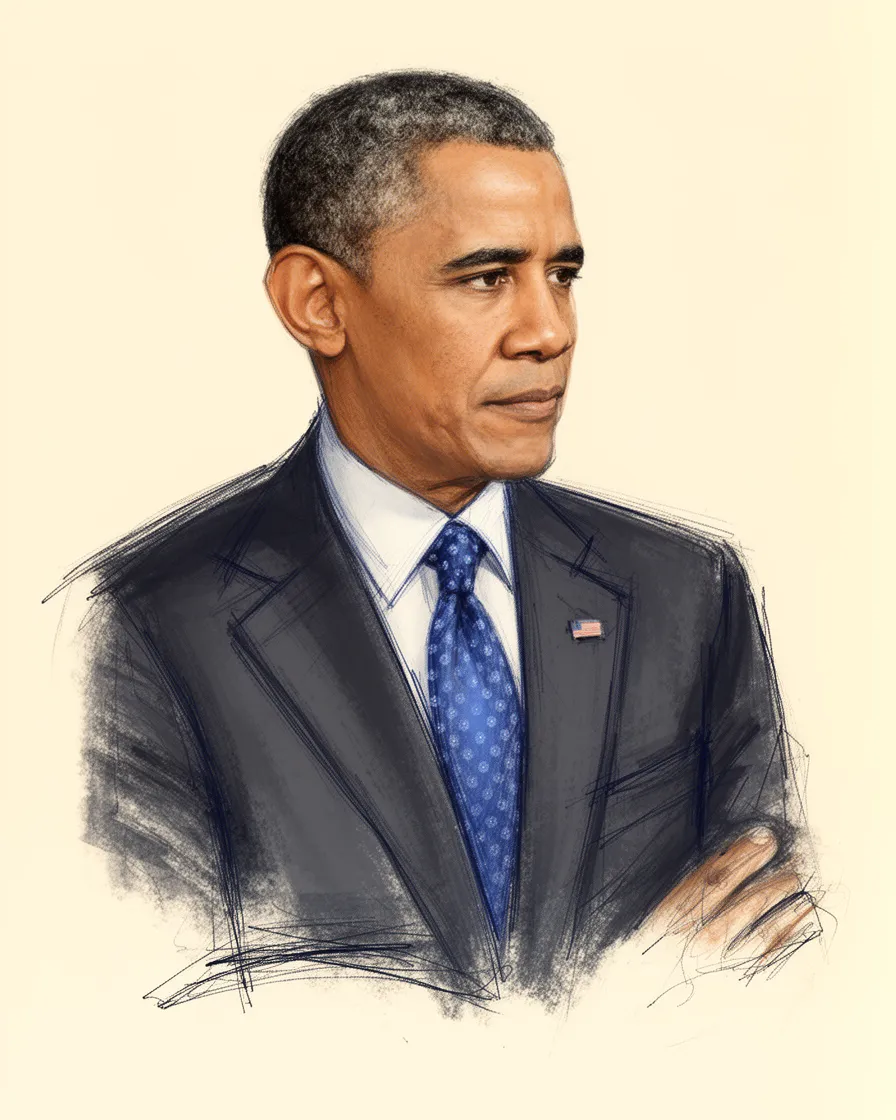

Barack Obama on Student Loans

President Barack Obama regarded high student loan debt as a major obstacle for young Americans, often stating that graduates who followed the rules were still being punished by debt loads averaging nearly $30,000 for four-year college seniors by graduation day. He highlighted that Americans owed more on student loans than on credit cards, contrasting this burden with the nation's pride in higher educational attainment. Obama frequently shared his personal experience of finally paying off his own student loans only about ten years before his presidency, emphasizing his passion for the issue.

Throughout his tenure, Barack Obama enacted several measures via executive authority to provide relief and manage repayment. Key among these was expanding the Pay As You Earn (PAYE) repayment plan to cap monthly payments for millions of federal direct loan borrowers at 10% of their income. He also directed efforts to cut out private banks as middlemen in the federal loan system, redirecting funds directly to students, and worked to increase awareness of existing tax credits and repayment options.

Despite executive actions, Obama consistently pushed for more substantial, legislative change from Congress. He strongly advocated for allowing college graduates with heavy debt to refinance their loans, frequently framing the vote on such legislation as a test of priorities between middle-class relief and tax breaks for millionaires. While acknowledging the need for colleges to control soaring tuition costs, his administration worked from multiple angles to ease the financial strain caused by student debt on the economy and individual families.

Context

Barack Obama's personal experience with student loans, which he and his wife Michelle Obama only finished paying off around 2005, informed his strong connection to the issue. As a product of public and private higher education, he framed access to college as a key path to opportunity and advancement in America. His administration viewed the high cost and resulting debt load as a constraint on the broader middle-class economic recovery following the Great Recession.

His actions, such as expanding income-based repayment, were often framed as the limit of what he could achieve through executive authority alone. This often led him to use such events to publicly pressure members of Congress to act on broader reforms like refinancing, which required legislative approval.

Timeline

- President Obama discussed the importance of college affordability and explicitly called on Congress to prevent federal Stafford loan interest rates from doubling that July.

- Obama took significant executive action to expand income-based repayment plans (PAYE) to millions more borrowers and publicly urged Congress to pass refinancing legislation.

- The President unveiled his 'student aid bill of rights,' focused on bringing more order to the chaotic system by improving communication from loan servicers and creating a single website for borrowers to track loans.

Actions Taken

- Executive Action / Repayment ReformSigned a memorandum directing the Secretary of Education to propose regulations expanding the Pay As You Earn (PAYE) plan to cap monthly payments for nearly 5 million federal direct loan borrowers at 10% of their income, making the program available to those who borrowed at any time in the past.

- Policy ReformReformed the student loan system to cut out private banks as middlemen, ensuring more money went directly to students.

- Aid ExpansionExpanded Pell Grant funding to support low-income students and created a tuition tax credit for middle-class families.

- Legislative PushCalled on Congress to pass legislation allowing college graduates with heavy debts to refinance their loans.

- Executive Action / Borrower RightsUnveiled a "student aid bill of rights" memo requiring loan servicers to better inform borrowers about repayment options and notify them when delinquent.

- Legislative PushCalled on Congress to stop interest rates on federal Stafford loans from doubling, which was set to occur in July after legislative action was not taken.

Key Quotes

I want to pay them off. and I'm working really hard. but I just can't make ends. meet. if somebody plays by the rules they shouldn't be punished for. it.

We can't price the middle class out of a college education... we can't make higher education a luxury it's an economic imperative.

We are here today because we believe that in America, no hard-working young person should be priced out of a higher education.

Criticism

While supporting his actions, they pushed Obama to support more aggressive legislative relief, such as refinancing, as his executive actions alone were seen as insufficient.

His efforts, particularly regarding refinancing, were often opposed as unnecessary government intervention or for creating tax loopholes for the wealthy, as suggested by Obama's framing of the legislative debate.

Sources5

President Obama Speaks on Student Loan Debt

President Obama unveils 'bill of rights' for student loans

President Obama Speaks on Student Loan Interest Rates in North Carolina

Obama moves to extend student loan payment relief

President Obama: "No Hardworking Young Person Should Be Priced Out of a Higher Education"

* This is not an exhaustive list of sources.