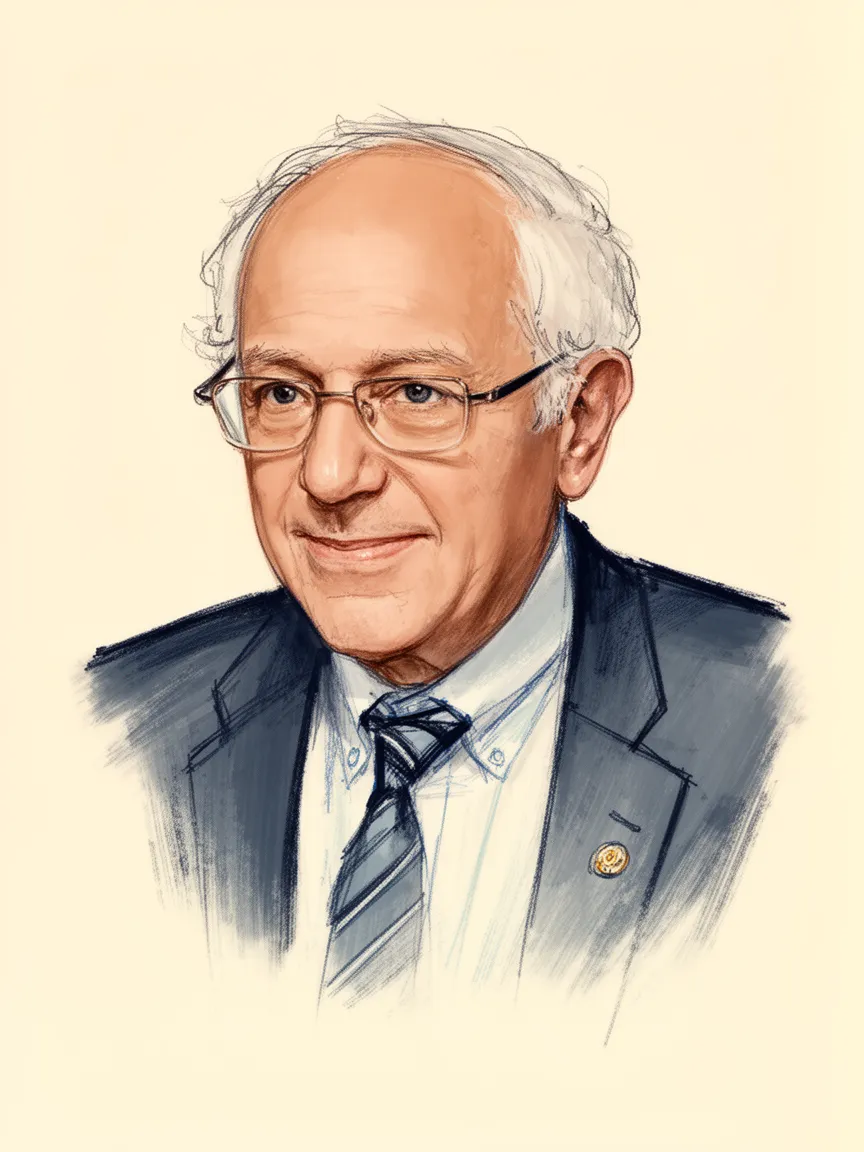

Bernie Sanders on Wall Street

Senator Bernie Sanders holds a consistently critical stance toward Wall Street, viewing large financial institutions as primarily serving the interests of the wealthy and corporations over working families. He often blames the financial sector for prioritizing profits over the well-being of the American middle class and the poor.

His positions advocate for comprehensive systemic reforms, including breaking up 'too big to fail' financial entities and implementing stricter regulations to curb excessive risk-taking and greed. Sanders has consistently blamed the industry for economic downturns and the resulting bailout packages that he opposed.

Fundamentally, Sanders connects the power of Wall Street to rising income and wealth inequality in the United States, arguing that their influence corrupts the political process. He seeks to fundamentally overhaul the financial regulatory structure to ensure the system works for the many, not the few.

Context

Bernie Sanders, serving as an Independent caucusing with Democrats, has long focused his political career on challenging economic inequality, with Wall Street as a primary target.

His criticism intensified following the 2008 financial crisis, which fueled his calls for structural financial reform. He views the sector's undue influence as a major obstacle to passing progressive legislation that benefits working people.

Timeline

- Voted against efforts to repeal parts of the Glass-Steagall Act, maintaining a clear line against deregulation of the banking sector.

- Criticized Federal Reserve Chair Alan Greenspan, stating Greenspan seemed 'way out of touch' and focused on serving the wealthy and large corporations.

- Voted against TARP funding, showing early opposition to government bailouts of financial institutions during the financial crisis.

- Delivered an 8-hour filibuster against tax cuts that he argued favored the wealthiest Americans, highlighting corporate greed.

- Called for comprehensive financial reforms including the breakup of 'too big to fail' institutions and restoring Glass-Steagall.

Actions Taken

- Voting RecordVoted against the Troubled Asset Relief Program (TARP), a bailout for major banks following the 2008 financial crisis.

- LegislationSponsored an amendment to the American Recovery and Reinvestment Act of 2009 to ensure TARP funds would not displace US workers.

- Voting RecordVoted and advocated against rolling back the Glass–Steagall Act provisions that separated investment and commercial banking.

- Policy ProposalCalled for comprehensive financial reforms, including breaking up 'too big to fail' financial institutions and restoring the Glass-Steagall Act.

Key Quotes

I believe that the financial crisis of 2008 was not an accident. It was the result of the greed, recklessness, and illegal behavior of Wall Street.

We must break up the big banks. Wall Street is too powerful and their greed has hurt working families all over this country.

Enough is enough! ... How many homes can you own?

Sources4

- Finance and monetary policy

- Economic issues

- The Speech: A Historic Filibuster on Corporate Greed and the Decline of Our Middle Class

- Our Revolution: A Future to Believe In

* This is not an exhaustive list of sources.