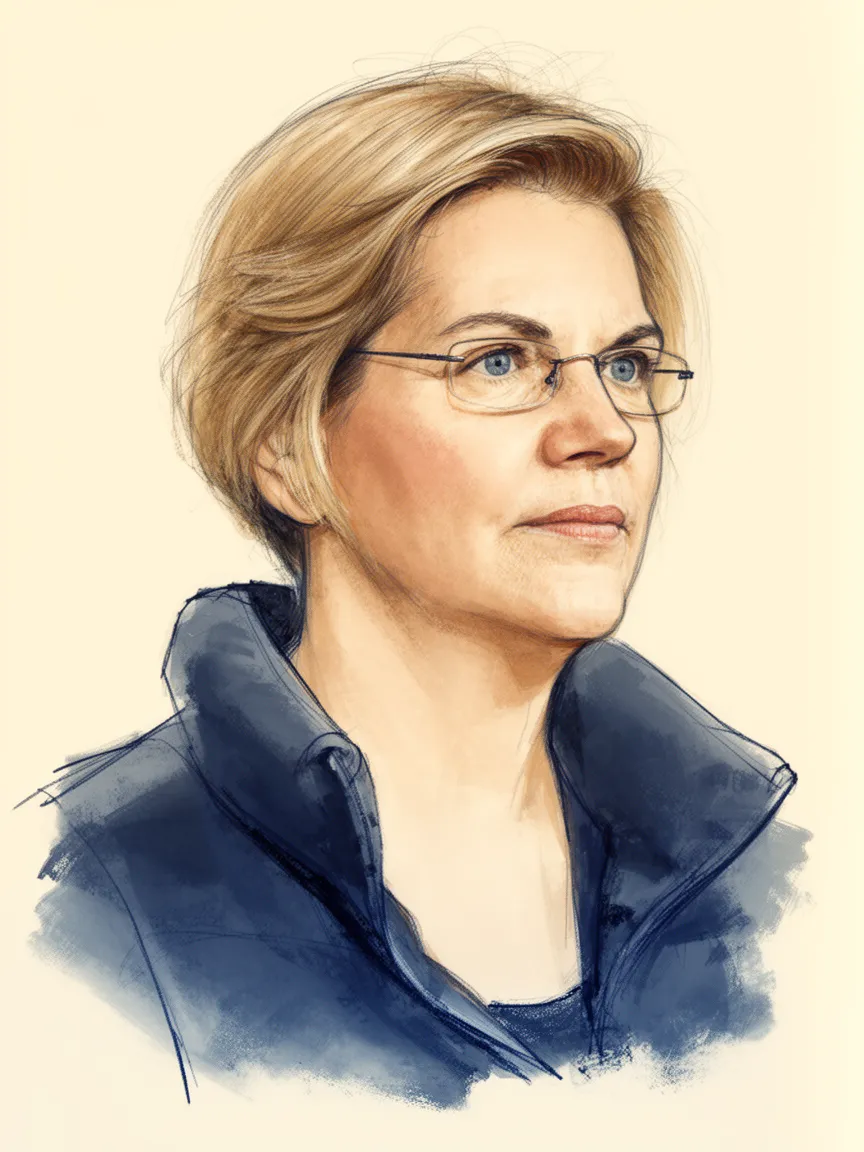

Elizabeth Warren on Interest Rates

Elizabeth Warren expresses a strong position that high interest rates, especially on credit cards, contribute significantly to the affordability crisis for American families. She has been working for years to bring these consumer borrowing costs down through legislative means, arguing that companies making billions in profit can afford lower rates. Warren views action on interest rates as a critical component of addressing the financial struggles of average households.

Her advocacy includes championing a cap on credit card interest rates, which she has discussed with figures across the political spectrum, including a publicized phone call with Donald Trump to explore a potential partnership. The Senator contends that the industry's warnings about such caps causing a credit shutdown are exaggerated, citing past industry reactions to other regulations. Warren's focus remains on direct regulatory action to curb what she perceives as exploitative lending practices that harm consumers.

This stance on interest rates is fundamentally tied to her broader consumer protection agenda, which also encompasses issues like housing supply and bank regulation. She explicitly links high credit card interest rates to the overall cost burden on families, suggesting that lowering rates would provide immediate financial relief. Warren has pushed for concrete legislative action, making this a core, consistent element of her policy platform.

Context

Elizabeth Warren's focus on interest rates is rooted in her role as a leading progressive voice and the Senate Banking Committee ranking member. This position gives her a relevant platform to discuss and pursue legislation related to banking practices, lending, and consumer finance. Her work often centers on tackling perceived excesses of the financial industry.

Her public statements position high interest rates, particularly on revolving credit like credit cards, as a direct driver of financial instability for working families. This contrasts with the prevailing view of some in the financial sector that high rates are necessary to manage risk or maintain liquidity for all consumers.

Timeline

- Senator Warren stated in a speech that if President Trump wanted to get something done regarding affordability, he should 'pick up the phone' about capping credit card interest rates.

- After a call from President Trump about capping credit card rates, Warren confirmed she told him Congress could pass the legislation if he fought for it, noting she has supported the plan for years.

- Discussed her long-standing work to get interest rates down and her conversation with President Trump regarding a 10% cap on credit card interest rates.

Actions Taken

- AdvocacyStated her long-standing support for legislation to cap credit card interest rates, directly engaging with the topic after a call from President Trump.

Key Quotes

I had been proposing that for years. Let's do it!

I told him that Congress can pass legislation to cap credit card rates if he will actually fight for it.

Are you defending 36% interest rate on credit cards or 28% interest on credit cards.

Comparison

- With Donald Trump: Initially critical of Trump's inaction on the issue, Warren expressed a willingness to work with him on capping credit card rates, viewing it as a point of potential, albeit unusual, bipartisan alignment for affordability.

- With Credit Card Industry: Warren is in direct opposition to the banking industry and card issuers, who strongly oppose interest rate caps, arguing it would reduce credit availability.

Sources5

Sen. Warren on Trump phone call, credit card rate cap and tackling affordability - YouTube

Do you agree with Senator Elizabeth Warren working with the Trump Administration in order to cap credit card interest rates? : r/AskALiberal - Reddit

Squawk Pod: Sen. Warren on a credit card rate cap and affordability - 01/14/26 | Audio Only

Sen. Elizabeth Warren says Congress could work with Trump to cap credit card rates

Trump phones Warren on affordability - POLITICO Pro

* This is not an exhaustive list of sources.