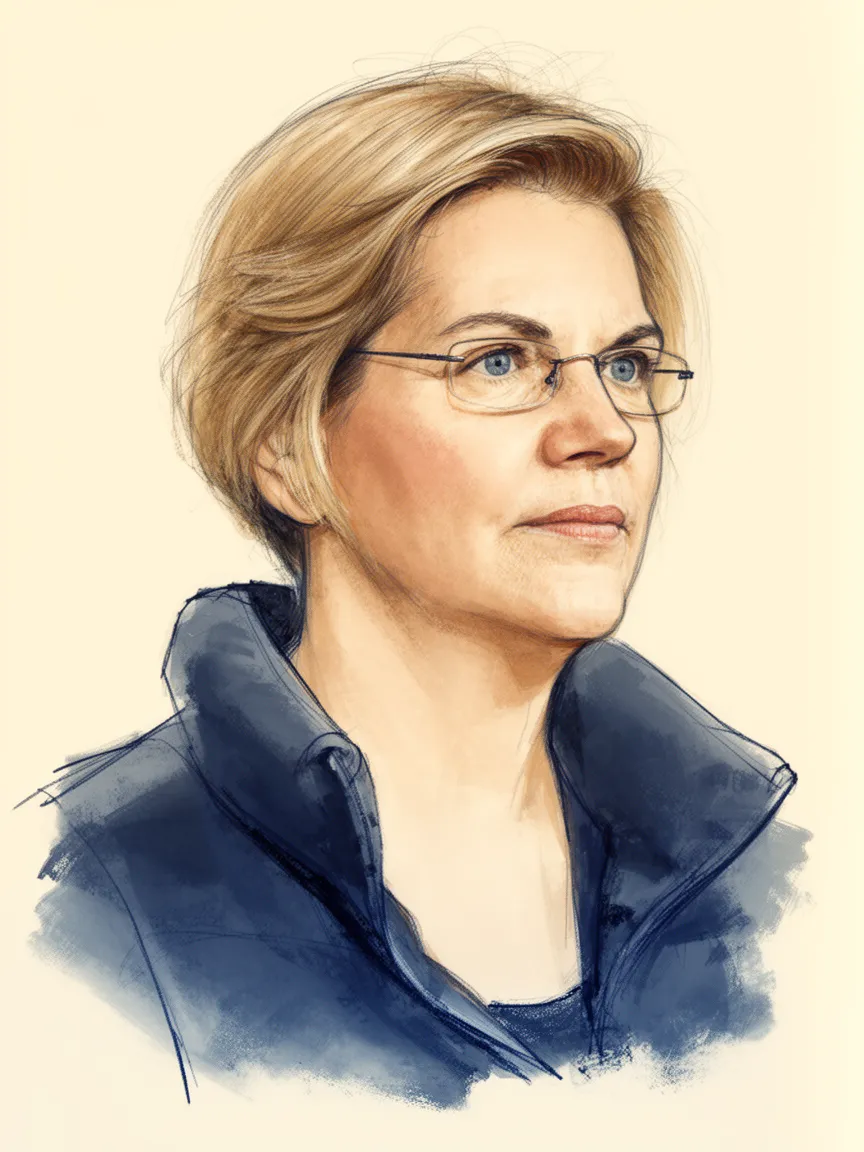

Elizabeth Warren on Jerome Powell

Elizabeth Warren has expressed strong disapproval of Jerome Powell's tenure as Federal Reserve Chair, particularly focusing on his actions concerning banking regulation and executive compensation.

Following events like the collapse of Silicon Valley Bank (SVB) in 2023, Warren asserted that Powell "took a flamethrower" to banking regulations, which she claims enabled risky behavior by bank executives that ultimately jeopardized the economy.

Her criticism is long-standing, including voting against his initial confirmation in 2018 and his renomination in 2022, maintaining that his policies and decisions have consistently favored large banks over financial stability.

Context

Elizabeth Warren has focused extensively on the role of financial regulators like Jerome Powell as part of her broader platform advocating for stronger consumer protections and stricter oversight of large financial institutions. Her perspective is heavily informed by her work following the 2008 financial crisis, which she believes was exacerbated by regulatory failures.

As a leading voice on the Senate Banking Committee, Warren possesses a significant platform to scrutinize the Federal Reserve's activities. Her opposition to Powell signals a fundamental disagreement over the appropriate level of regulation for major banks.

Timeline

- Senator Warren opposed Jerome Powell's initial confirmation as Federal Reserve Chair.

- Warren vowed to oppose Powell's renomination, calling him a "dangerous man" during a Senate banking committee hearing.

- Warren voted against President Biden's renomination of Jerome Powell for a second term as Fed Chair.

- Warren heavily criticized Powell following the Silicon Valley Bank collapse, claiming he weakened necessary regulations.

- Warren grilled Powell in a Senate hearing over his inaction on executive compensation reform mandated by the Dodd-Frank Act.

Actions Taken

- Official CorrespondenceWrote a letter to the Federal Reserve's inspectors general urging them to ensure their internal probes into the SVB collapse were free of influence from Fed Chair Powell, citing his responsibility for the regulatory environment.

- Legislative Hearing TestimonyUrged Jerome Powell to "do his job" and join other regulators in issuing rules to tackle executive compensation that incentivizes excessive risk-taking, referencing the Dodd-Frank Act mandate.

Key Quotes

"Jerome Powell just took a flamethrower to the regulations, weakened them, weakened them, weakened dozens of the regulations and then the CEOs of the banks did exact he what we expected."

“Look,” she said Sunday. “I don't think he should be chairman of the Federal Reserve.”

“Your record gives me grave concerns. Over and over, you have acted to make our banking system less safe, and that makes you a dangerous man to head up the Fed, and it's why I will oppose your renomination.”

“Chair Powell, the law does not say: Jerome Powell in his infinite wisdom should decide if we have a problem with executive compensation. The law… says: executive pay is a problem that threatens the stability of our economy, so write the rules to rein them in.”

Sources5

Elizabeth Warren blasts Fed chair Jerome Powell, says he 'took a flamethrower' to banking regulations

Elizabeth Warren Is Right: Jerome Powell Should Be Held to Account

At Hearing, Warren Slams Powell for Cozying-Up to Big Banks and Inaction on Executive Compensation Reform, Calls for Rulemaking that Protects Stability of the American Economy

Elizabeth Warren opposed Jerome Powell. Now she worries Trump will fire him

Elizabeth Warren calls Fed chair he is 'dangerous' and opposes renomination

* This is not an exhaustive list of sources.