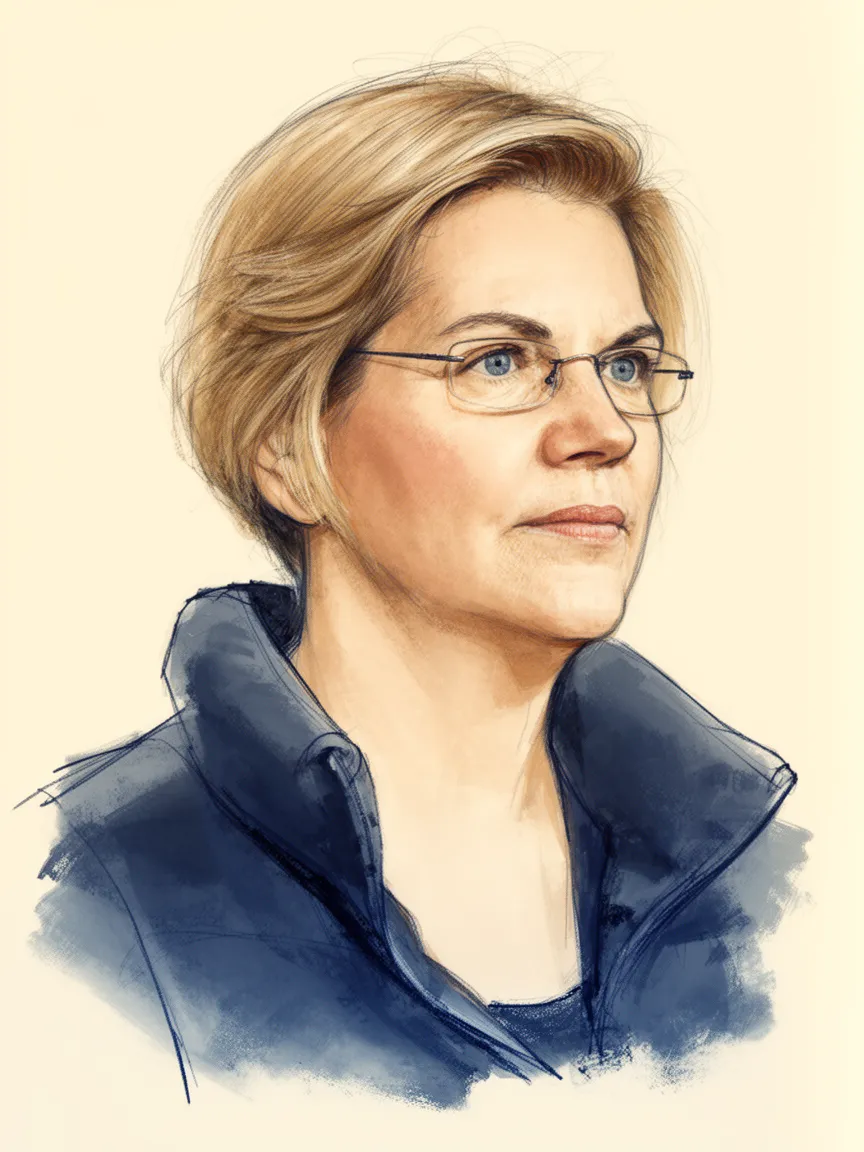

Elizabeth Warren on Private Equity Regulation

Elizabeth Warren believes the private equity industry operates under rules that allow fund managers to extract massive profits while leaving portfolio companies, workers, and communities vulnerable to collapse and debt.

She advocates for strong legislative action, primarily through the Stop Wall Street Looting Act, to fundamentally reform these practices by increasing transparency and assigning liability to the firms rather than just the acquired companies.

Warren argues that this regulation is necessary to stop what she terms "legalized looting" and to ensure that private equity executives share in the losses when their risky bets fail, aligning their interests with those of stakeholders.

Context

Elizabeth Warren focuses on private equity regulation due to her broader platform of addressing systemic inequality and holding large financial institutions accountable for actions that harm workers and consumers. Her critique often centers on the perceived incentive structure of private equity firms, which she argues prioritizes short-term extraction of value over long-term company health.

This focus intensified during her 2020 presidential campaign and continues through her Senate work, exemplified by her attempts to tackle the carried interest loophole, a key tax benefit for fund managers. Her approach seeks to fundamentally reshape corporate law and financial oversight concerning leveraged buyouts.

Actions Taken

- Legislation SponsorshipIntroduced the Stop Wall Street Looting Act alongside colleagues, which aims to fundamentally reform the industry by imposing firm liability, limiting fee extraction, and changing compensation rules.

- Campaign Finance StanceAnnounced she would not accept campaign donations over $200 from private equity executives during her presidential run, cementing her stance against the industry.

- Legislation ProposalProposed legislation in 2013 that would have restricted commercial banks from investing in the private equity industry to limit its sway.

- Legislation ReintroductionReintroduced the Stop Wall Street Looting Act alongside colleagues, continuing the push for sweeping reform.

- Sector Specific LegislationIntroduced the Corporate Crimes Against Health Care Act of 2024 with Senator Markey to target private equity abuse specifically within the health care system, proposing criminal penalties for executives following 'triggering events.'

Key Quotes

Private equity firms get rich off of stripping assets from companies, loading them up with a bunch of debt, and then leaving workers, consumers, and whole communities in the dust.

Let's call this what it is: legalized looting.

This bill would end private equity's 'heads-I-win, tails-you-lose' business model that has destroyed the American retail industry in recent years.

Sources5

Elizabeth Warren Proposes Private Equity Regulations

Elizabeth Warren's Long, Thankless Fight Against Our Private Equity Overlords

Senators Warren and Markey Introduce Private Equity Legislation

Regulating Private Equity by Aligning PE Fund and Stakeholder Interests? A Look at Senator Warren's Proposal

Warren, Baldwin, Brown, Pocan, Jayapal, Colleagues Reintroduce Bold Legislation to Fundamentally Reform the Private Equity Industry

* This is not an exhaustive list of sources.