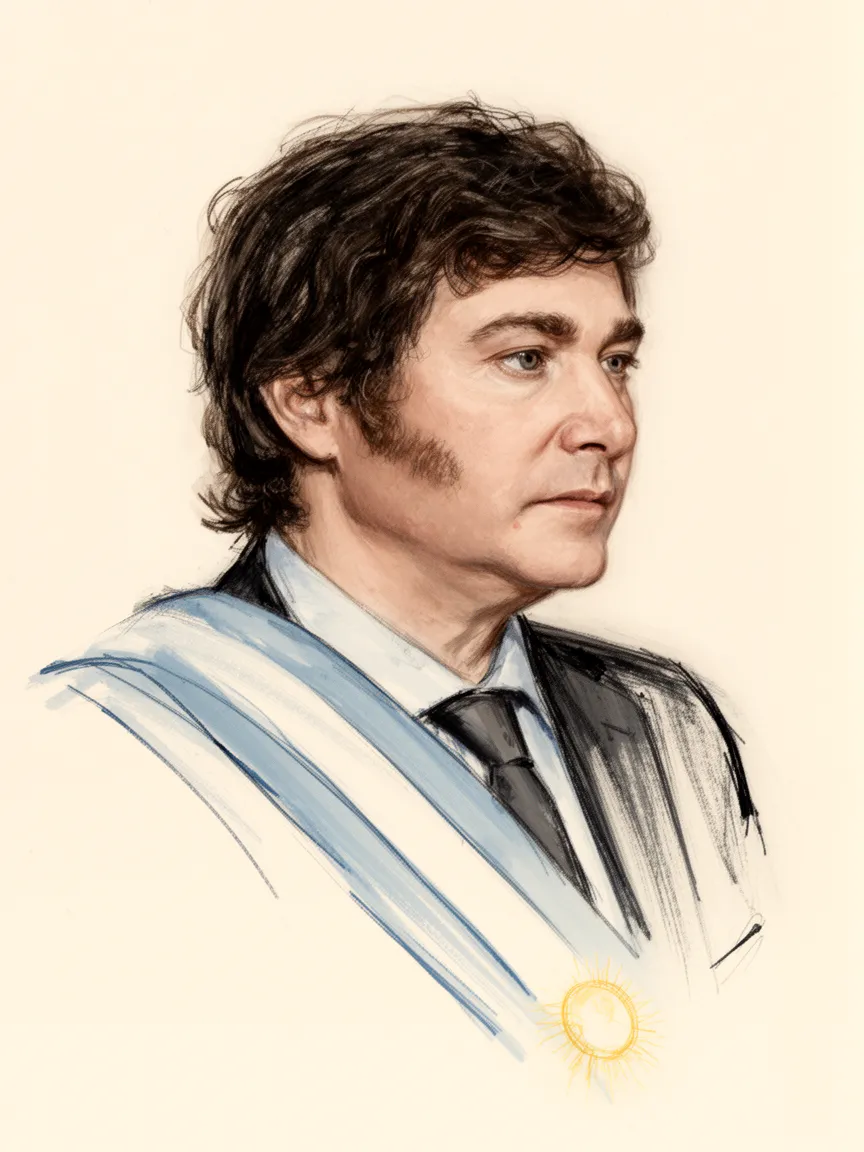

Javier Milei on Taxes

Javier Milei views the Argentine tax system critically, fundamentally opposing the state's ability to finance itself through what he perceives as forced taxation. As an economist aligned with the Austrian school, he advocates for minimal government intervention, which naturally entails significant tax reduction and simplification.

During his campaign for the Chamber of Deputies, Milei explicitly pledged not to support any tax increases or new taxes. This anti-tax stance has been a consistent feature of his political discourse, framing high taxes as inherently linked to what he terms the "parasitic political caste."

As President, Javier Milei has proposed comprehensive tax overhauls aimed at simplifying the overall tax burden to foster economic growth and restore fiscal balance. While his administration has pushed for reforms, including passing a tax bill, his fundamental position remains centered on reducing state revenue streams derived from compulsory levies.

Context

Javier Milei's views on Taxes are inseparable from his broader minarchist and anarcho-capitalist ideology. He sees the state as an entity that largely extracts wealth coercively, making taxes the primary mechanism of that extraction, which conflicts with his core principles of life, liberty, and property.

His economic platform, heavily influenced by the Austrian School of Economics, prioritizes free-market principles. Therefore, reducing the scope and power of the state necessarily involves dismantling its main source of funding: the current structure of taxation.

Timeline

- While campaigning for the Chamber of Deputies, Javier Milei made a firm commitment regarding fiscal policy.

- Upon taking office as President, Milei immediately pursued comprehensive economic reforms.

- As part of his agenda for the new Congress seating in December 2025, Milei confirmed continued focus on fiscal restructuring.

Actions Taken

- LegislationPassed a tax and 'omnibus' bill in June 2024, which included reforms concerning the tax system as part of a broader deregulation effort.

- Policy AnnouncementAnnounced a 'new economic roadmap' featuring structural reforms aimed at simplifying the tax burden for the next legislative session.

Sources4

Javier Milei - biography by the Barcelona Centre for International Affairs

Javier Milei's Government Plan Unveiled

President Javier Milei’s party won a landslide victory in midterm elections, making it easier for Milei to push ahead with his programme of radical spending cuts and free-market reforms.

Milei achieved a budget surplus within the first few months in office by gutting chunks of the government structure and downsizing it drastically and reducing the salaries of high ranking authorities, leading to a reduction of government spending by 30%.

* This is not an exhaustive list of sources.